FBS Next

Value Proposition

FBS Next provides highly qualified services to the most relevant credit institutions, making use of a strong and proven expertise in the NPL sector, both from a consultancy and management perspective.

Over the past 25 years Strocchi family have provided services for major Italian and International banks achieving a proven expertise in NPL sector, managing assets for €15bn (270k positions and litigation rate < 0,1%).

In 2019, Strocchi family sold FBS to Banca Ifis and in 2020 founded FBS Next.

FBS Next manages around €1.8bn AuM. new business opportunities owning 51% share in the Italian special servicing market.

Fitch Ratings assigned to FBS Next a 3+ rating, a significative result considering the small number of servicer that have achieved this recognition.

Key People

Paolo Strocchi

President

Lawyer, entrepreneur, and auditor, with over 50 years’ experience in credit institutions.

In 1997, he founded FBS S.p.A., a company operating in the NPL sector,

In 1999 he founded FBS – Ocwen. Partner company Ocwen US is listed on Wall Street and a leader in the U.S. in the field of bad debt recovery.

In 2006 he founded FBS Real Estate S.p.A., which implements the real estate business in the management and evaluation of loans.

In 2019, FBS S.p.A. has been sold to Banca IFIS. The company at the time managed 10 billion NPLs for over 200,000 positions.

In 2020, founded FBS Next S.p.A. assuming the position of Chairman and majority shareholder

Federico Strocchi

CEO

Since 2020, holding the position of CEO of FBS next.

Previously, in 2019, served as Vice President of FBS spa (Banca Ifis Group) and Chairman of FBS Real Estate (Banca Ifis Group).

Served as CEO of FBS spa from 2003 to 2016, subsequently serving as chairman until 2019.

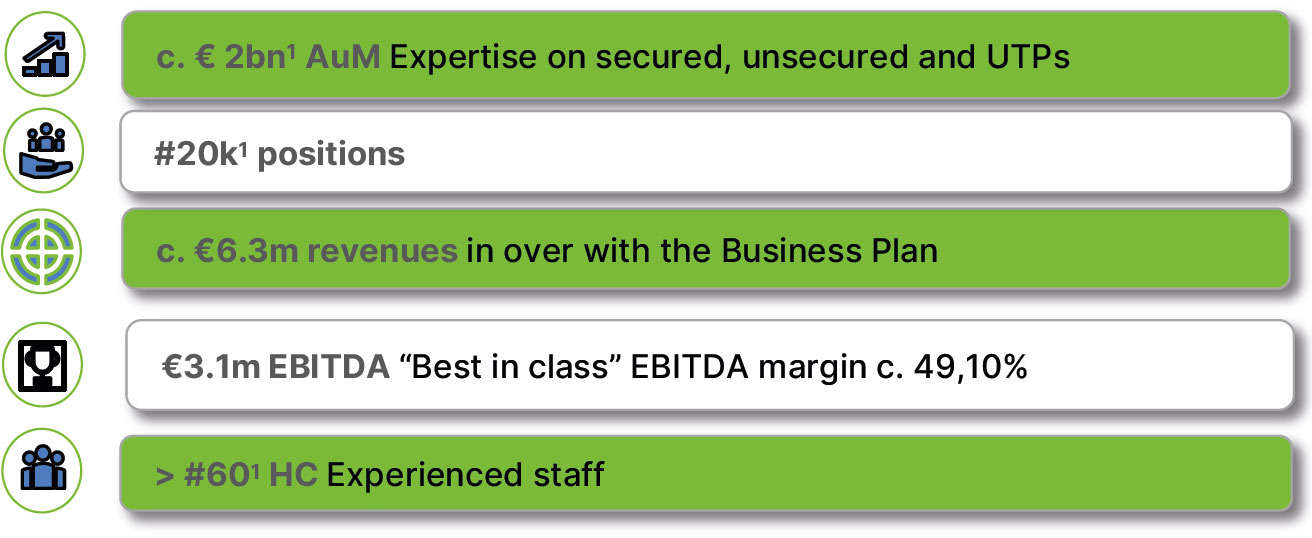

Key facts and figures

FBS next overview

- Founded in the last quarter of 2020, FBS Next is a NPE servicer that expresses know-how and perspective vision combined with technology

- FBS Next has already completed #10 acquisitions of NPE portfolios and #6 outsourced management contracts of NPL and UTP positions; the latest has just been completed with BPER, for a total managed amount of around €2bln and #20k positions

- FBS Next has a solid expertise in Past Due and UTP management, through an internally programmed tool of UTP management, that can propose the solution that maximizes value for Bank\Fund

- Fitch Ratings assigned to FBS Next a 3+ rating, significative result considering the small number of servicer that have achieved this recognition

- FBS next holds 30% of FBS next STA whose goal is to support banks and servicer in the legal management of impaired loans optimizing recovery timelines and costs associated with procedures

KPIs FY23

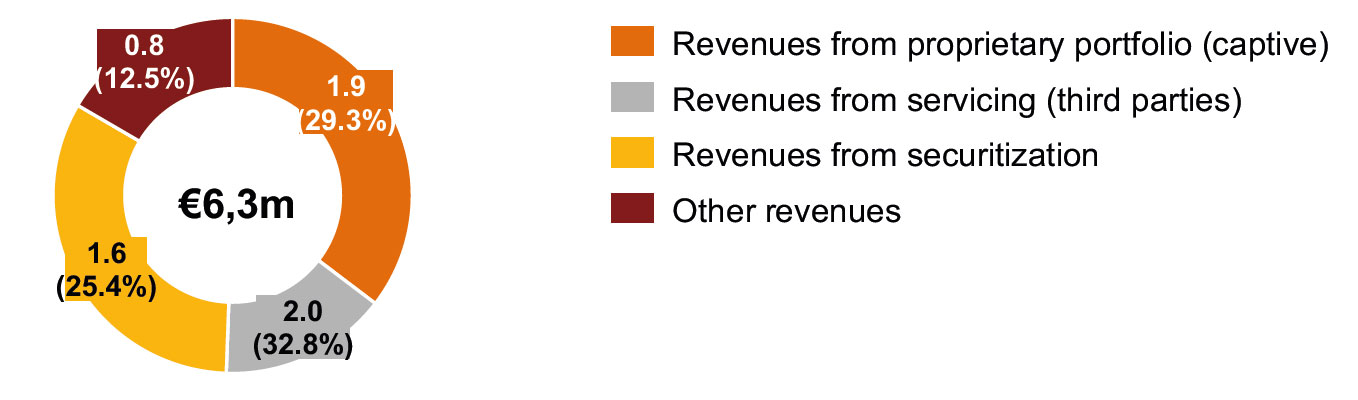

Revenues breakdown FY23 (€m)

Revenues breakdown FY23 (€m)

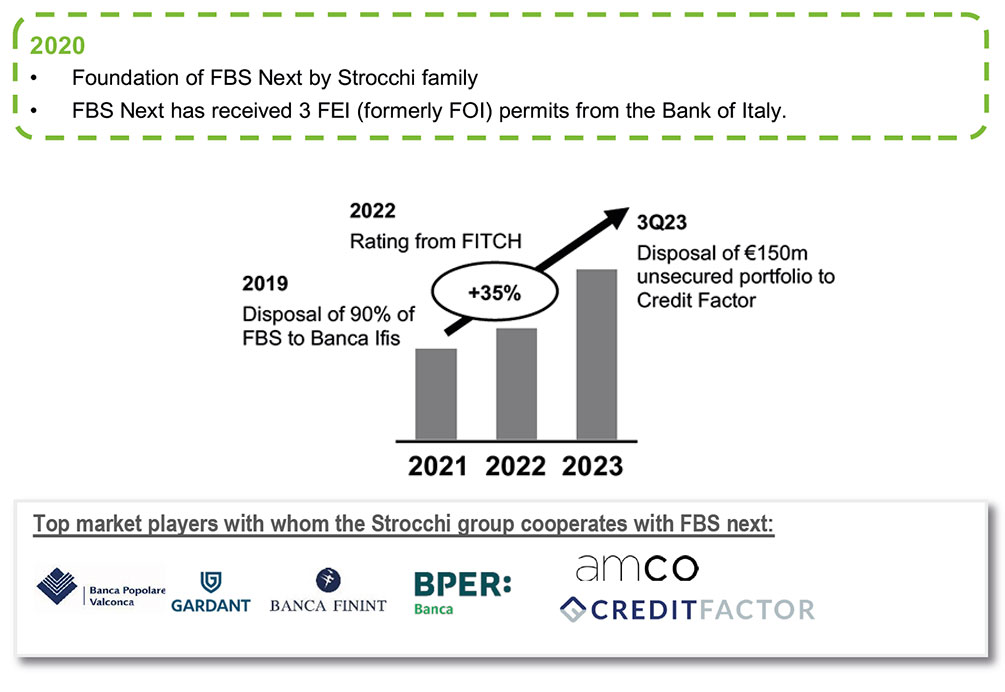

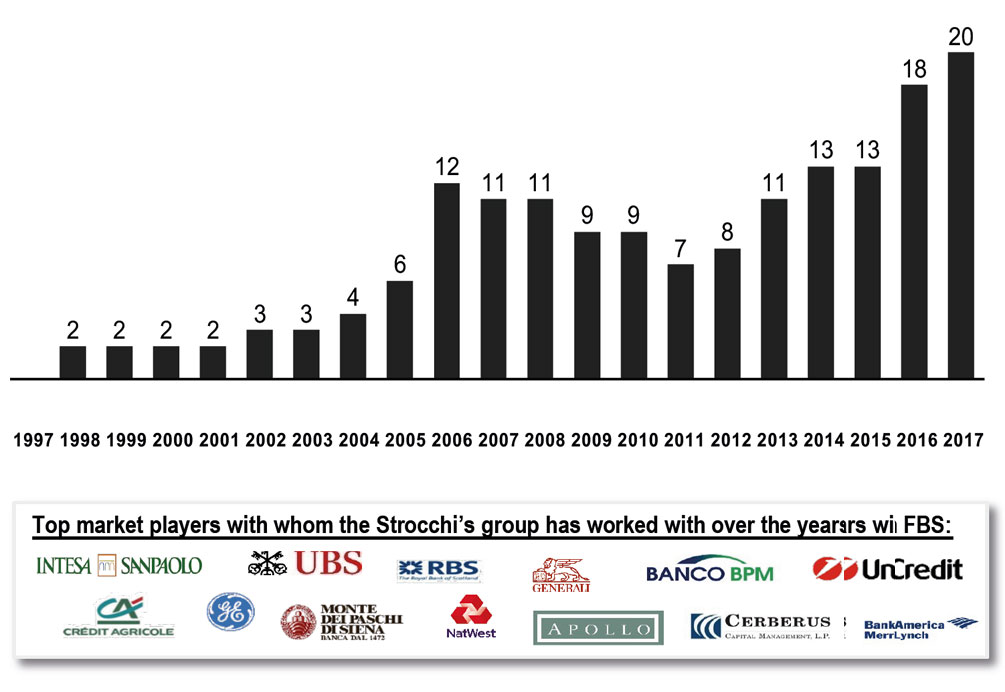

Strocchi family: a compelling growth story

Over the past 25 years Paolo Strocchi and family have provided services for the major banks achieving a proven expertise in NPE sector, managing assets for €15bln (270k positions and litigation rate < 0,1%). In 2019 the family sold FBS to Banca Ifis and in 2020 founded FBS next.

Strocchi’s family key milestones and FBS revenues evolution (€m)

Establishment

of FBS next